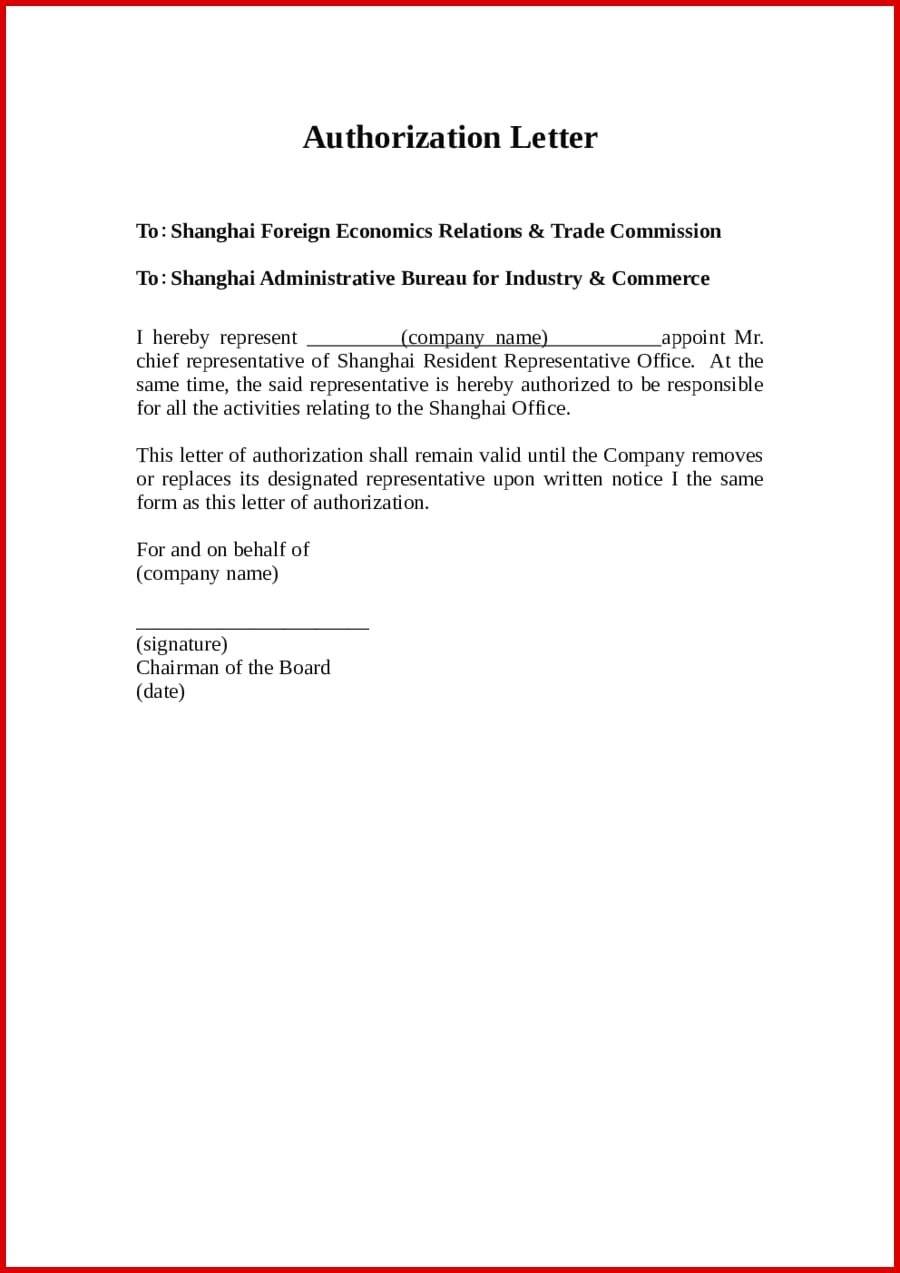

Letter Of Authorization Template For Business Template Business Format

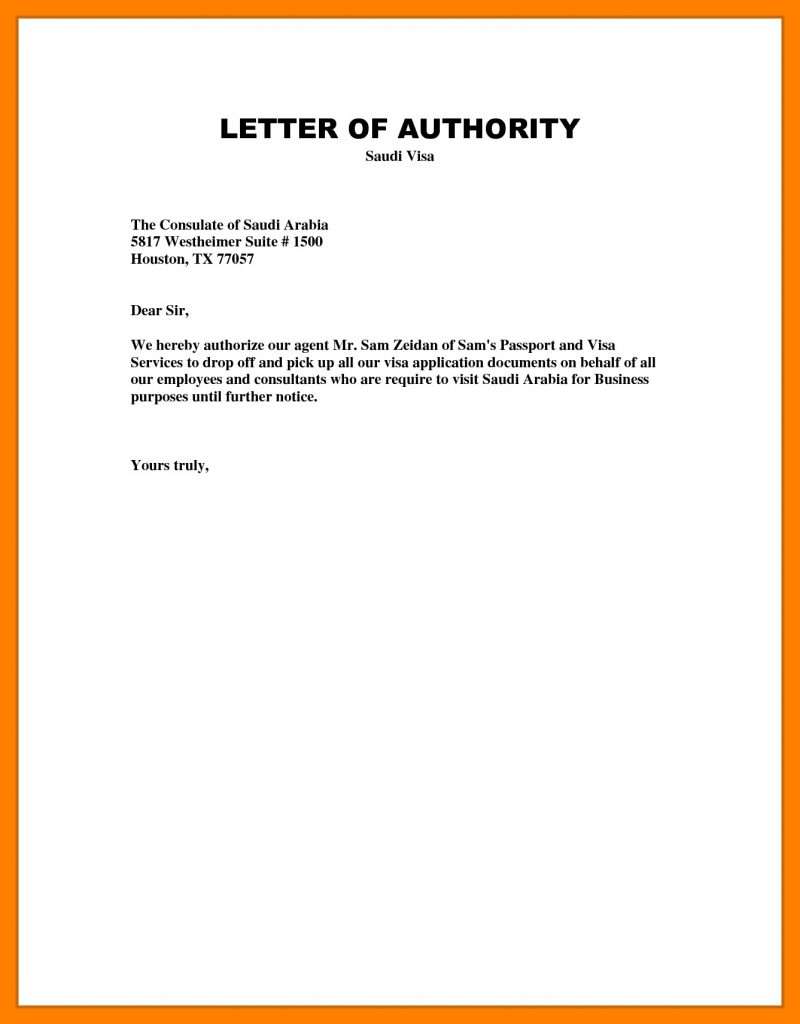

Authorisation letter for GST Registration (partnership firm) Authorisation letter is considerably the legal formality that is required to carry out business operations. It is an important aspect that is required for conducting day to day transaction in a business. It is a letter that enforces the responsibility to the third party for carrying.

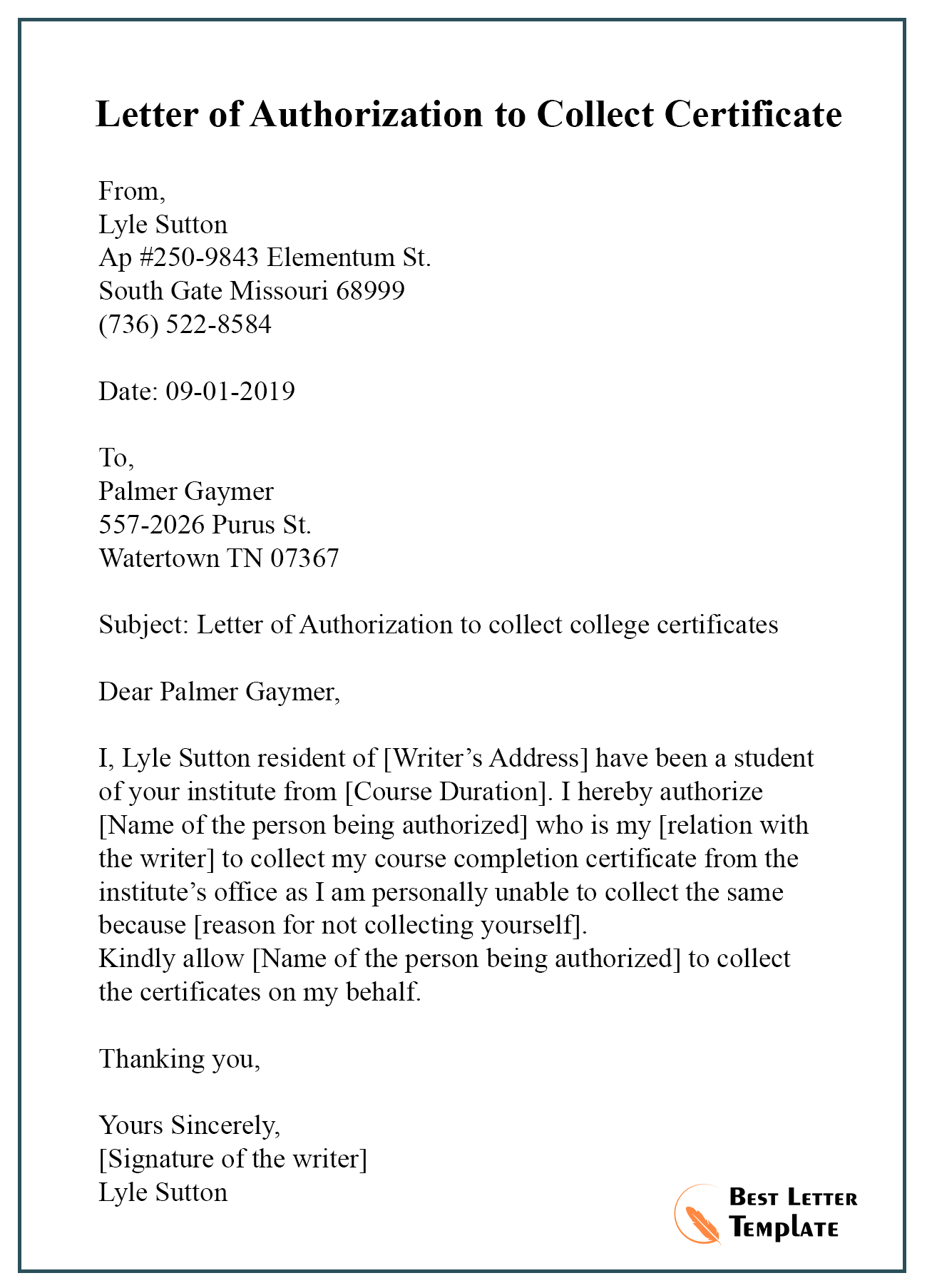

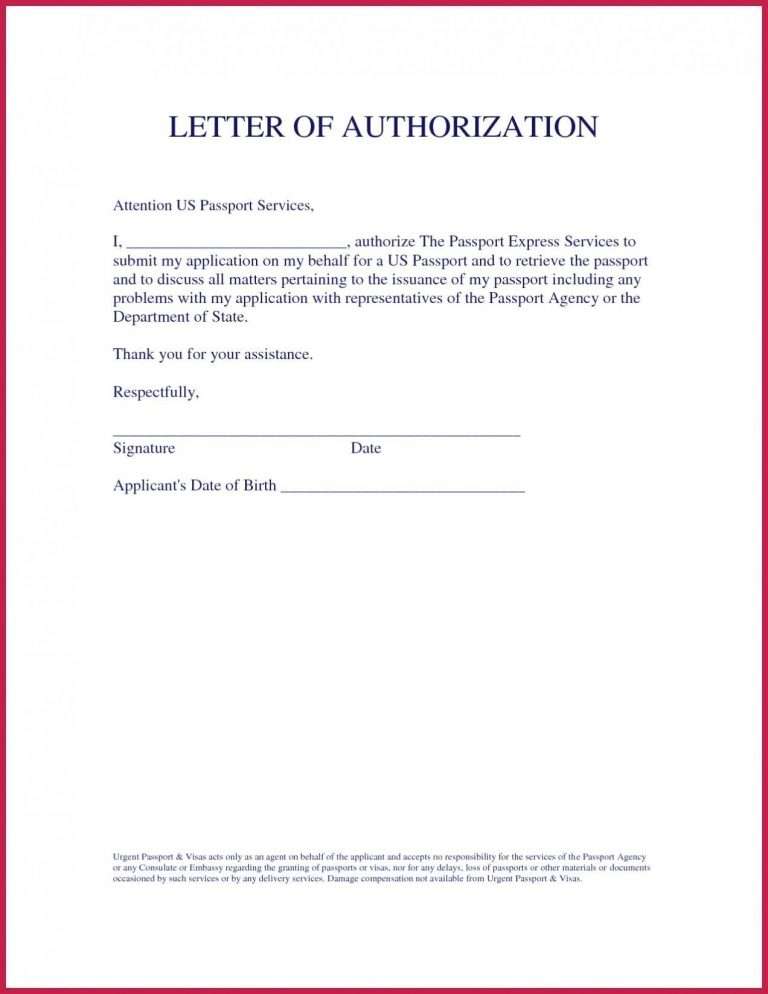

Sample of Authorization Letter Template with Example Authorization Letter

The partnership firm's letter of authorization will be considered valid only when it is signed by all the partners. In the absence of the authorised signatory, the partners and directors of the company can act as authorised signatories. The GST portal allows a maximum of 10 authorised signatories. But in such cases where multiple authorised.

Authorization letter format for representative Gratis

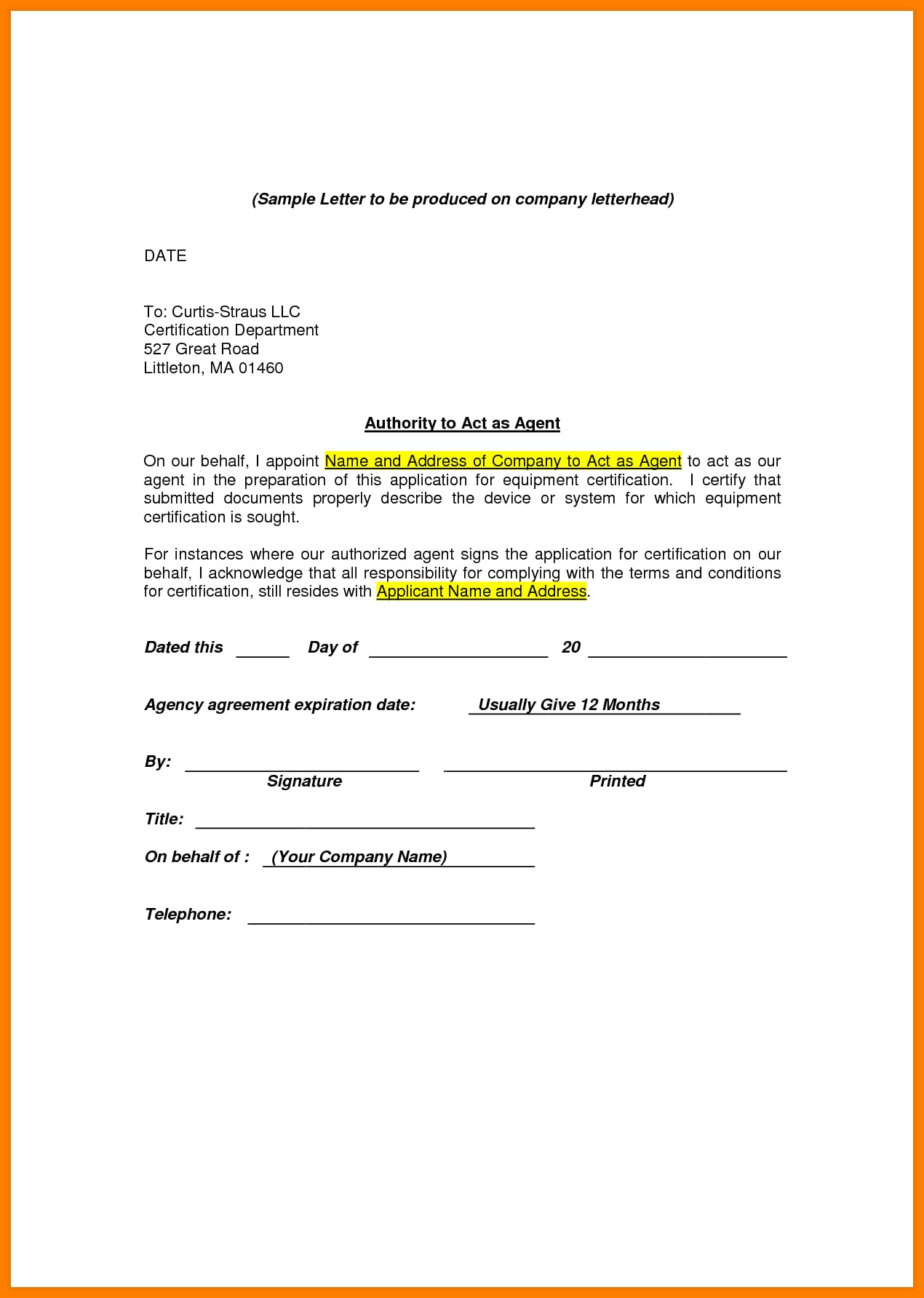

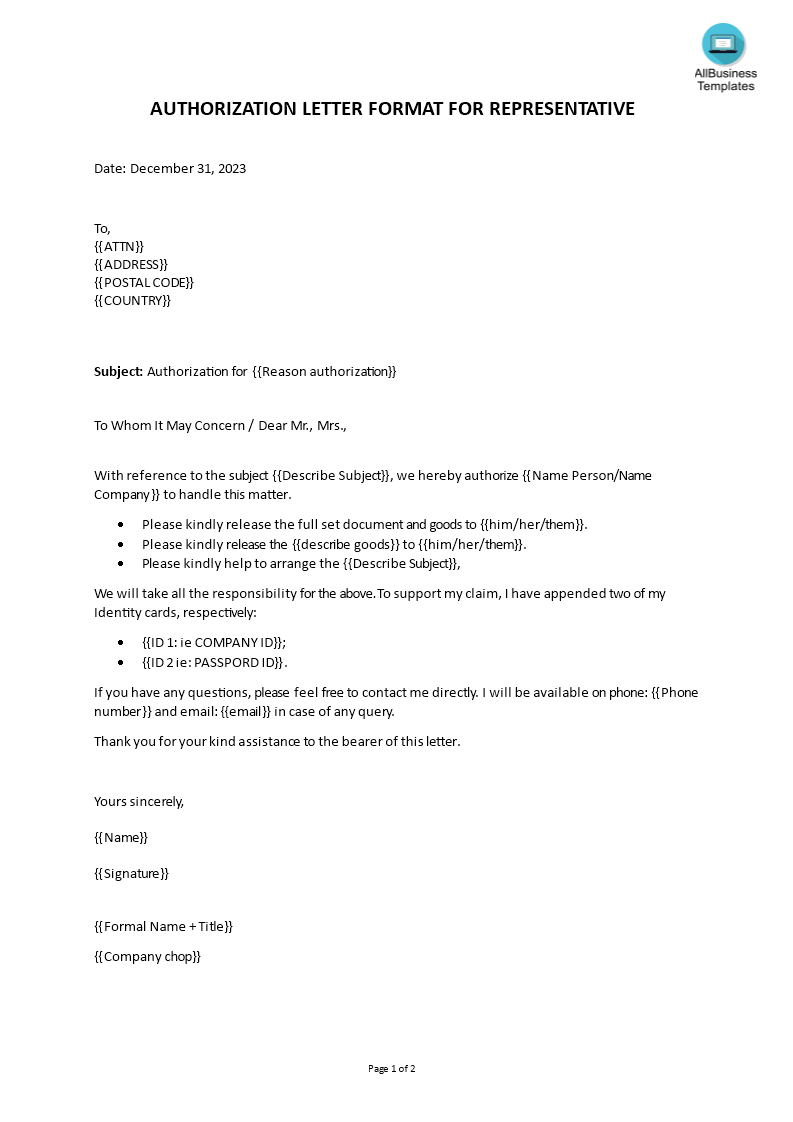

Step # 4: Write the Salutation. After completing the letter head, now comes the time to write the body of the authorization letter. You should write the salutation using appropriate titles such as Mr., Mrs., Ms. and Dr. You should not use their first names. Also, the salutation should open with either To or Dear.

Sample Authorization Letter Template with Examples in PDF

PARTNERSHIP AUTHORIZATION RESOLUTION PAGE 2 of 3 PO Box 1950 West Lafayette, IN 47996 765.497.3328 // 800.627.3328 PURDUEFED.COM BE IT RESOLVED THAT, the Partners certify the following information for each individual who directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise, owns 25 percent or more.

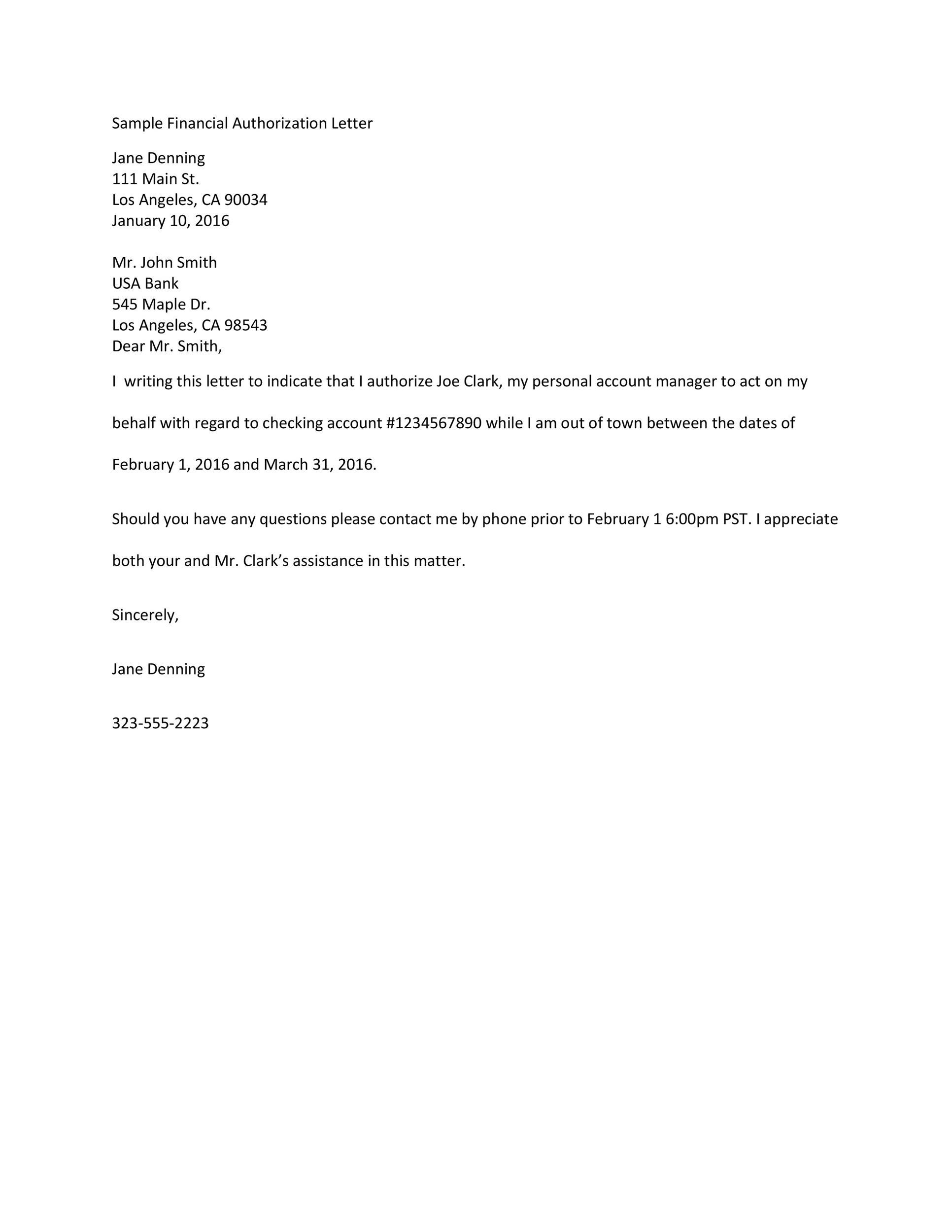

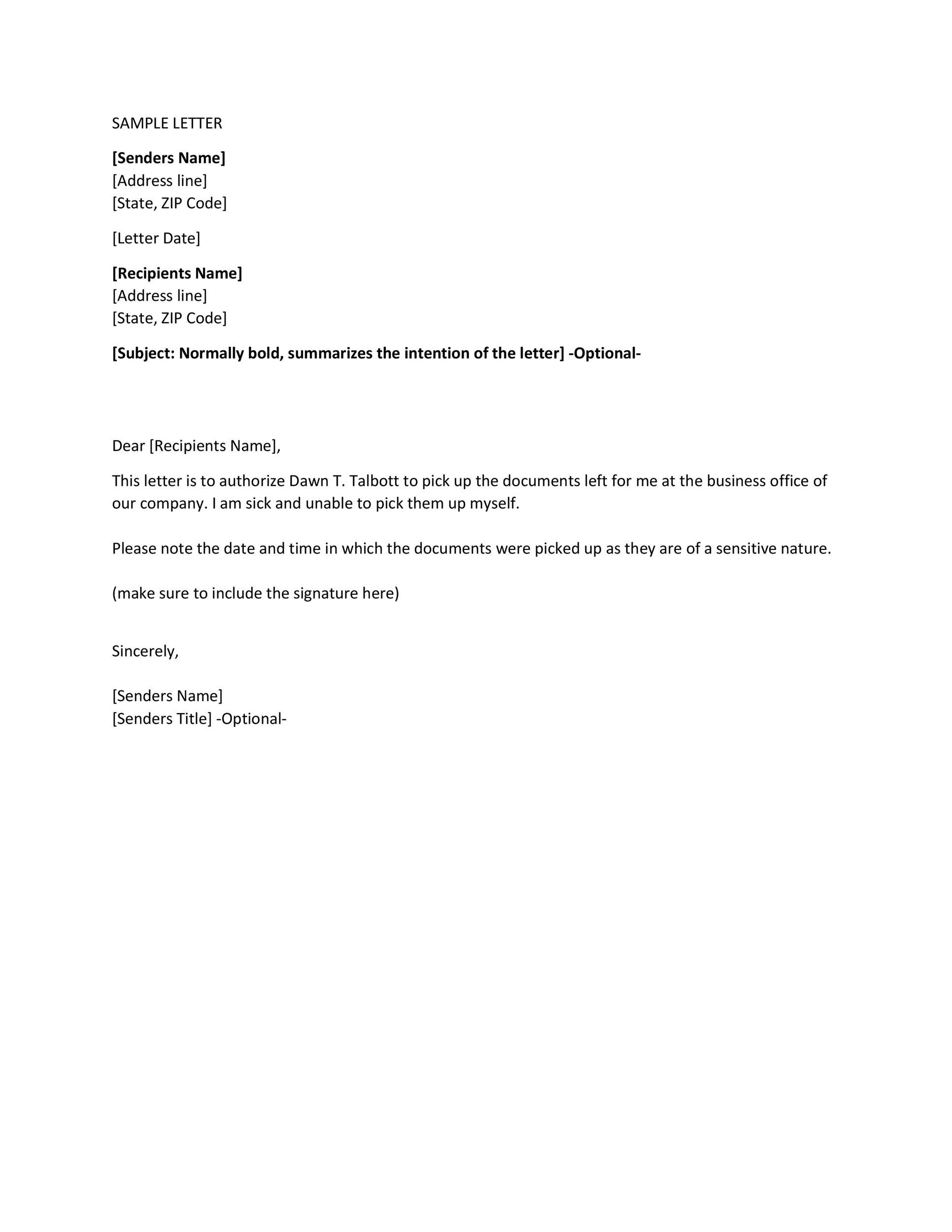

46 Authorization Letter Samples & Templates ᐅ TemplateLab

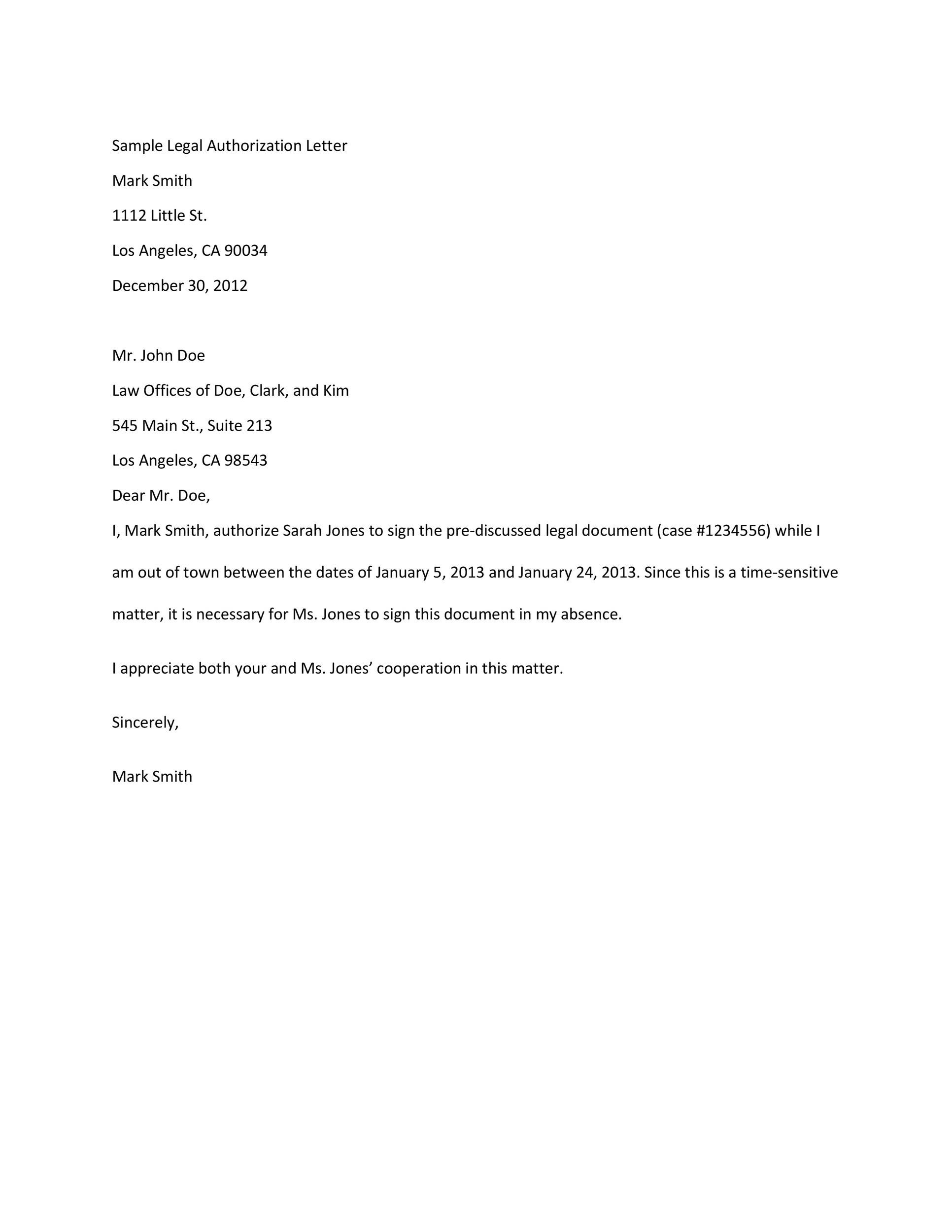

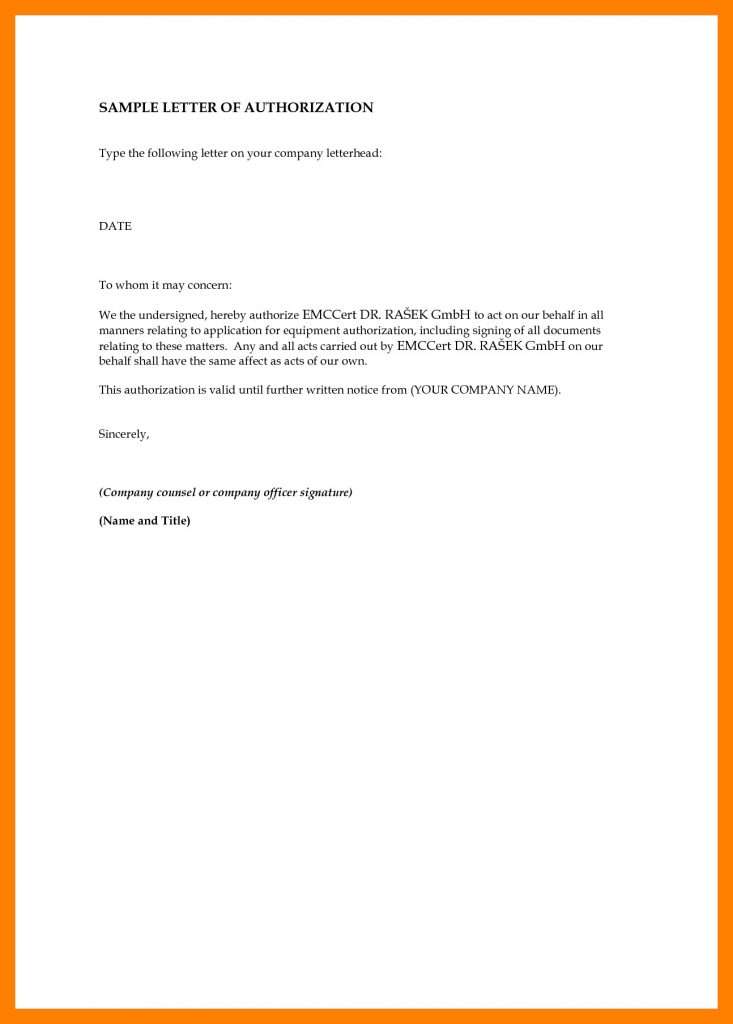

The authorization letter is proof that both parties have authorized the partnership and have agreed to it. This letter can be kept for legal reasons if needed later. Tips to create a partnership authorization letter: When making the partnership authorization letter you need to show that it is serious and professional.

Authorisation letter for GST Registration (partnership firm) PARTNERSHIPFIRMAUTHORIZATION

Write the recipient's name and address first when addressing an authorization letter to them. Include the date you wrote the letter and a subject line that describes its goal. Start the letter out with a salutation or greeting before moving on to the letter's body. Indicate the action to be conducted and the person's name being approved.

FREE 8 Sample letter of Authorization in MS Word PDF

Format for Authorization Letter for GST Partnership Firm. Richa Sharma, Aadhar number: 456789123789 D/o Mr. Ranjan Sharma, R/o 54, Hari Villas, Delhi. Aman Gupta, Aadhar number: 986543298512 S/o Mr. Alok Gupta, R/o 88, Green Fields, New Delhi. Hereby agree and declare that Mr. Aman Gupta, Manager, Zenith Technologies, is going to act as the.

Partnership Consent Letter CIB1 Online Banking Transaction Account

I, (mention the name of the person) am writing this letter to do to give full authority to Mr (Name of the authorized person) to act and sign all the documents and papers related to our organization (mention the name) on behalf of me, as I will be out of town for few days.

FREE 11+ Letter of Authorization Templates in PDF MS Word Pages

For GST Enrollment/Registration, Partnership Firm have to upload a Authorization Letter for Authorized Person, If you are applying for GST Enrollment/Registration on behalf of your Partnership Firm, then Download Partnership Firm Authorization Letter from here and modify as per your firm details.

Sample Letter Of Authorization To Represent

There is no fixed format of authorisation letter for GST registration for partnership firms. You can prepare your own letter with all the required contents in it as necessary. Hereunder is a template of such an authorisation letter for GST registration for partnership firms, which is made as a declaration by the existing partners of the firm.

21+ Free Authorization Letter Sample Template and Examples (2022)

Here are the steps you should take to form a partnership in California: Choose a partnership name. File a fictitious business name statement with the county clerk. Draft and sign a partnership agreement. Apply for licenses, permits, and zoning clearance. Obtain an employer identification number (EIN).

46 Authorization Letter Samples & Templates ᐅ TemplateLab

Bank Authorization Letter Sample. Sam Marcus 18 Industry Inc. 123 456 7890 [email protected] Dew Bank Plc Macintosh Inc. 23 Andrew Squ. My name is Sam Marcus, and I am writing this letter to grant James Fallon access to my account 123456789. My identification number is 098765432, and a copy of my identification number has been attached to this.

46 Authorization Letter Samples & Templates ᐅ TemplateLab

Firms have shared the following ways they have used prior FINRA publications, such as Exam Findings Reports, Priorities Letters and Reports on FINRA's Examination and Risk Monitoring Program, to enhance their compliance programs. We encourage firms to consider these practices, if relevant to their business model, and continue to provide feedback on how they use FINRA publications.Assessment.

46 Authorization Letter Samples & Templates ᐅ TemplateLab

Resolution Format for Partnership Firms To be typed and printed on the Letter Head of the Partnership Firm Date: To, IndusInd Bank Limited, <

> Re: Authority Letter for opening an Current Account, booking a Fixed Deposit and availing the Internet Banking Facility ("Services ")

4+ Sample of Authorization Letter For GST in PDF Word (Docs)

While registering a Partnership firm in GST, we need to submit a Partnership Authorization letter declaring a Partner as Authorized Signatory. एक Partnership फर्म का GST रजिस्ट्रेशन करते समय हमें एक Authorization Letter देना होता है, किसी एक Partner को Authorized Signatory बनाने के लिए I

Sample of Authorization Letter Template to Act on Behalf

Previously, the IRS observed a surge in these seasonal "new client" scams where identity thieves target accounting groups and tax preparation firms with fake emails. This year, the IRS has already observed reports of new client scams. Typically, the new client scam peaks during tax season, which runs from January through April.